December 25 2025 Update – 7’783 USD Unrealized P&L

Base Currency: USD

Total Portfolio Value: 55,557

Unrealized P&L: +7,7783

Realized P&L: $0.00

Cash Available: $101.13

Maintenance Margin: $14,719.64

Excess Liquidity: $40,589.06

Buying Power: $161,647.59

| 🏷️ Ticker | 🏢 Company | 💰 Market Value | 📈 Unrealized P&L % | 💰 Unrealized P&L |

|---|---|---|---|---|

| MU | 💾 Micron Technology | $3,785.94 | +177.4% | +$2,420 |

| GOOGL | 🔍 Alphabet | $2,906.93 | +87.1% | +$1,350 |

| CAT | 🚜 Caterpillar | $1,134.27 | +68.6% | +$461 |

| TSM | 🧪 Taiwan Semi | $1,465.88 | +57.6% | +$536 |

| AAPL | 🍏 Apple | $444.59 | +37.7% | +$122 |

| LLY | 💉 Eli Lilly | $285.23 | +25.7% | +$58 |

| MC | 👜 LVMH | $252.33 | +25.4% | +$51 |

| BABA | 🧧 Alibaba | $1,219.53 | +25.2% | +$246 |

| BTI | 🚬 British American Tobacco | $516.26 | +23.2% | +$97 |

| PLTR | 🧠 Palantir | $363.89 | +20.9% | +$63 |

| TCEHY | 🧧 Tencent | $983.73 | +19.7% | +$162 |

| ASML | 🛠 ASML Holding | $2,667.74 | +18.7% | +$420 |

| QCOM | 📡 Qualcomm | $1,040.45 | +14.5% | +$131 |

| AMD | 🧠 AMD | $1,430.43 | +13.1% | +$166 |

| NVDA | 🎮 NVIDIA | $5,066.27 | +10.1% | +$465 |

| CRSP | 🧬 CRISPR Therapeutics | $814.58 | +8.3% | +$63 |

| BA | ✈️ Boeing | $551.23 | +7.9% | +$40 |

| META | 🧠 Meta Platforms | $836.55 | +6.0% | +$48 |

| CSSMI | 🇨🇭 iShares SMI ETF | $3,097.72 | +5.2% | +$152 |

| VOO | 📈 S&P 500 ETF | $18,519.95 | +4.7% | +$830 |

| AMZN | 📦 Amazon | $2,016.05 | +4.5% | +$86 |

| ORA | 📞 Orange | $247.43 | +9.5% | +$21 |

| OR | 💄 L’Oréal | $172.73 | -5.2% | -$10 |

| TXN | 🧮 Texas Instruments | $441.81 | -4.0% | -$18 |

| MSFT | 🪟 Microsoft | $2,478.08 | -3.2% | -$81 |

| ADBE | 🎨 Adobe | $440.67 | -8.8% | -$42 |

| JD | 📦 JD.com | $338.15 | -12.9% | -$50 |

| PYPL | 💳 PayPal | $491.09 | -18.3% | -$110 |

| BYDDY | 🚗 BYD | $244.83 | -30.1% | -$105 |

July 6th 2025 $20,445 Portfolio Update +13.79% in 68 Days

🧺 Portfolio Breakdown – Holdings, Weights & Values

Base Currency: USD

Total Portfolio Value: $20,436.99

Unrealized P&L: +$1,320.81

Realized P&L: $0.00

Cash Available: $9.13

Dividends (Accrued): $17.99

Maintenance Margin: $5,947.11

Excess Liquidity: $14,471.89

Buying Power: $57,349.13

| 🏷️ Ticker | 🏢 Company | 💰 Market Value (USD) | ⚖️ Weight % |

|---|---|---|---|

| CSSMI | 🇨🇭 iShares SMI ETF | $1,883.14 | 9.71% |

| GOOGL | 🔍 Alphabet | $1,582.03 | 8.16% |

| MU | 💾 Micron | $1,345.70 | 6.94% |

| MSFT | 🪟 Microsoft | $1,161.71 | 5.99% |

| BABA | 🧧 Alibaba | $938.59 | 4.84% |

| VOO | 📈 S&P 500 ETF | $935.54 | 4.82% |

| QCOM | 📡 Qualcomm | $925.86 | 4.77% |

| TSM | 🧪 Taiwan Semi | $893.77 | 4.61% |

| META | 🧠 Meta Platforms | $893.81 | 4.61% |

| ASML | 🛠 ASML Holding | $830.15 | 4.29% |

| CAT | 🚜 Caterpillar | $899.04 | 4.63% |

| TCEHY | 🧧 Tencent | $825.41 | 4.25% |

| NVDA | 🎮 NVIDIA | $803.69 | 4.15% |

| PYPL | 💳 PayPal | $600.94 | 3.10% |

| BA | ✈️ Boeing | $540.80 | 2.79% |

| TXN | 🧮 Texas Instruments | $538.48 | 2.77% |

| CRSP | 🧬 CRISPR Therapeutics | $499.09 | 2.57% |

| ADBE | 🎨 Adobe | $480.84 | 2.47% |

| AMZN | 📦 Amazon | $454.57 | 2.34% |

| BTI | 🚬 British American Tobacco | $438.30 | 2.26% |

| AAPL | 🍏 Apple | $463.08 | 2.39% |

| JD | 📦 JD.com | $370.62 | 1.91% |

| BYDDY | 🚗 BYD | $299.20 | 1.54% |

| ORA | 📞 Orange | $234.06 | 1.21% |

| LLY | 💉 Eli Lilly | $206.40 | 1.06% |

| MC | 👜 LVMH | $174.77 | 0.90% |

| OR | 💄 L’Oréal | $169.15 | 0.87% |

| Cash | 💵 Cash (USD) | $9.13 | 0.05% |

June 24th 2022 $12,516 Portfolio Update +%11.64 in 46 Days!

🧺 Full Portfolio with P&L % and Unrealized Gains

| 🏷️ Ticker | 🏢 Company | 📈 Unrealized P&L % | 💰 Unrealized P&L |

|---|---|---|---|

| MU | 💾 Micron | +42.2% | +$297.00 |

| NVDA | 🎮 NVIDIA | +33.8% | +$170.00 |

| TSM | 🧪 Taiwan Semiconductor | +21.2% | +$154.00 |

| ASML | 🛠️ ASML | +17.5% | +$124.00 |

| META | 🧠 Meta | +19.4% | +$105.00 |

| MSFT | 🪟 Microsoft | +13.5% | +$102.00 |

| CAT | 🚜 Caterpillar | +12.2% | –$57.70 |

| TXN | 🧮 Texas Instruments | +18.4% | +$56.90 |

| AMZN | 📦 Amazon | +10.0% | +$27.80 |

| BTI | 🚬 British American Tobacco | +14.7% | +$17.40 |

| QCOM | 📡 Qualcomm | +5.56% | +$17.10 |

| GOOGL | 🔍 Alphabet | +1.59% | +$11.30 |

| TCEHY | 🧧 Tencent | +2.34% | +$7.50 |

| AAPL | 🍏 Apple | +1.43% | +$4.63 |

| ORA | 📞 Orange | –0.41% | –$0.92 |

| BA | ✈️ Boeing | –2.99% | –$4.78 |

| ADBE | 🎨 Adobe | –0.99% | –$4.80 |

| JD | 📦 JD.com | –5.00% | –$6.86 |

| BYDDY | 🚗 BYD | –2.03% | –$7.11 |

| OR | 💄 L’Oréal | –5.21% | –$9.49 |

| MC | 👜 LVMH | –10.0% | –$20.20 |

| LLY | 💉 Eli Lilly | –9.79% | –$22.20 |

| BABA | 🧧 Alibaba | –9.31% | –$30.10 |

| CSSMI | 🇨🇭 iShares SMI ETF | –2.58% | –$50.40 |

Updated June 15 2025 Updated // Rate of Return (All-time) 9.34% $12,516.11 USD Total Market Value of Assets – Liabilities

| 🏷️ Ticker | 🏢 Company | 📈 Unrealized P&L % | 💰 Unrealized P&L | ⚖️ Weight |

|---|---|---|---|---|

| CSSMI | 🇨🇭 iShares SMI ETF | –1.34% | –$26.10 | 17.42% |

| MSFT | 🪟 Microsoft | +9.66% | +$73.10 | 6.76% |

| TSM | 🧪 Taiwan Semiconductor | +16.3% | +$119.00 | 6.51% |

| GOOGL | 🔍 Alphabet | +5.99% | +$42.70 | 6.37% |

| ASML | 🛠️ ASML | +10.4% | +$73.30 | 6.32% |

| MU | 💾 Micron | +28.8% | +$202.00 | 6.28% |

| META | 🧠 Meta | +14.7% | +$79.30 | 4.80% |

| NVDA | 🎮 NVIDIA | +28.9% | +$146.00 | 4.49% |

| ADBE | 🎨 Adobe | +1.14% | +$5.50 | 4.31% |

| CAT | 🚜 Caterpillar | +7.97% | +$37.60 | 4.22% |

| BYDDY | 🚗 BYD | –1.58% | –$5.55 | 3.13% |

| AAPL | 🍏 Apple | –1.17% | –$3.79 | 2.89% |

| BABA | 🧧 Alibaba | –12.2% | –$39.50 | 2.89% |

| TCEHY | 🧧 Tencent | +1.03% | +$3.30 | 2.87% |

| TXN | 🧮 Texas Instruments | +12.3% | +$38.00 | 2.76% |

| QCOM | 📡 Qualcomm | +5.06% | +$15.60 | 2.75% |

| AMZN | 📦 Amazon | +9.15% | +$25.40 | 2.49% |

| LLY | 💉 Eli Lilly | –4.62% | –$10.50 | 2.03% |

| ORA | 📞 Orange | –1.19% | –$2.68 | 2.02% |

| MC | 👜 LVMH | –8.65% | –$17.40 | 1.80% |

| OR | 💄 L’Oréal | –4.05% | –$7.37 | 1.63% |

| BA | ✈️ Boeing | –3.15% | –$5.04 | 1.44% |

| JD | 📦 JD.com | –4.35% | –$5.96 | 1.23% |

| BTI | 🚬 British American Tobacco | +15.2% | +$18.00 | 1.05% |

Updated May 26 2025 Updated

🧺 Full Portfolio Update with P&L & Weights (Fresh Update)

| 🏷️ Ticker | 🏢 Company | 💰 Unrealized P&L | ⚖️ Weight |

|---|---|---|---|

| MSFT | 🪟 Microsoft | +$47.70 | 6.31% |

| TSM | 🧪 Taiwan Semiconductor | +$47.30 | 6.48% |

| GOOGL | 🔍 Alphabet | +$28.10 | 3.94% |

| ASML | 🛠️ ASML | +$47.50 | 6.70% |

| MU | 💾 Micron | +$37.10 | 5.28% |

| META | 🧠 Meta | +$47.20 | 8.78% |

| NVDA | 🎮 NVIDIA | +$112.00 | 22.3% |

| ADBE | 🎨 Adobe | +$35.20 | 7.28% |

| CAT | 🚜 Caterpillar | +$23.60 | 5.00% |

| BYDDY | 🚗 BYD | –$13.30 | -3.79% |

| AAPL | 🍏 Apple | +$2.53 | 0.78% |

| BABA | 🧧 Alibaba | –$37.90 | -11.7% |

| TCEHY | 🧧 Tencent | –$7.05 | -2.20% |

| TXN | 🧮 Texas Instruments | +$15.60 | 5.04% |

| QCOM | 📡 Qualcomm | –$4.27 | -1.39% |

| AMZN | 📦 Amazon | +$15.00 | 5.40% |

| LLY | 💉 Eli Lilly | –$31.80 | -14.0% |

| ORA | 📞 Orange | +$5.06 | 2.24% |

| MC | 👜 LVMH | –$9.27 | -4.61% |

| OR | 💄 L’Oréal | –$4.76 | -2.61% |

| BA | ✈️ Boeing | –$0.10 | -0.07% |

| JD | 📦 JD.com | –$7.56 | -5.51% |

| BTI | 🚬 British American Tobacco | +$7.24 | 6.14% |

Older:

📈 Portfolio Snapshot 📉

| 🏷️ Ticker | 🏢 Company | 💰 Unrealized P&L | ⚖️ Weight |

|---|---|---|---|

| AAPL | 🍏 Apple | +$4.54 | 3.87% |

| ADBE | 🎨 Adobe | +$28.57 | 4.37% |

| AMZN | 📦 Amazon | +$12.10 | 2.35% |

| ASML | 🛠️ ASML | +$41.54 | 6.69% |

| BA | ✈️ Boeing | +$3.57 | 1.89% |

| BABA | 🧧 Alibaba | –$19.69 | 3.68% |

| BTI | 🚬 British American Tobacco | +$7.91 | 1.53% |

| BYDDY | 🚗 BYD | +$37.33 | 2.87% |

| CAT | 🚜 Caterpillar | +$22.83 | 2.67% |

| CSSMI | 🇨🇭 iShares SMI ETF | +$12.04 | 23.70% |

| GOOGL | 🔍 Alphabet | +$20.36 | 4.73% |

| JD | 📦 JD.com | +$3.72 | 1.62% |

| LLY | 💉 Eli Lilly | –$37.83 | 2.30% |

| MC | 👜 LVMH | +$5.94 | 2.37% |

| META | 🧠 Meta | +$31.33 | 5.08% |

| MSFT | 🪟 Microsoft | +$35.81 | 6.29% |

| MU | 💾 Micron | +$37.11 | 4.00% |

| NVDA | 🎮 NVIDIA | +$96.79 | 7.30% |

| OR | 💄 L’Oréal | +$4.91 | 2.15% |

| ORA | 📞 Orange | +$8.95 | 2.85% |

| QCOM | 📡 Qualcomm | +$4.38 | 3.68% |

| TCEHY | 🧧 Tencent | +$7.86 | 4.06% |

| TSM | 🧪 Taiwan Semiconductor | +$46.25 | 5.23% |

| TXN | 🧮 Texas Instruments | +$8.29 | 1.41% |

💵 Total Value: $9’558.14 (including cash): $12,060 USD

-Rate of Return (All) 5.37%

older update

| 🏷️ Ticker | 🏢 Company | 💰 Unrealized P&L | ⚖️ Weight |

|---|---|---|---|

| MSFT | 🪟 Microsoft | +$39.00 | 7.55% |

| META | 🧠 Meta | +$53.60 | 2.59% |

| NVDA | 🎮 NVIDIA | +$118.00 | 4.65% |

| ADBE | 🎨 Adobe | +$21.60 | 4.12% |

| GOOGL | 🔍 Alphabet | +$14.10 | 4.10% |

| AAPL | 🍏 Apple | +$22.10 | 4.19% |

| QCOM | 📡 Qualcomm | +$11.70 | 6.33% |

| MU | 💾 Micron | +$44.10 | 9.41% |

| TXN | 🧮 Texas Instruments | +$15.80 | 1.50% |

| ASML | 🛠️ ASML | +$80.40 | 9.58% |

| TSM | 🧪 Taiwan Semiconductor | +$53.30 | 5.32% |

| OR | 💄 L’Oréal | –$5.59 | 2.54% |

| MC | 👜 LVMH | +$8.57 | 2.42% |

| BABA | 🧧 Alibaba | +$15.00 | 4.10% |

| AMZN | 📦 Amazon | +$21.30 | 2.72% |

| CAT | 🚜 Caterpillar | +$26.90 | 2.72% |

| LLY | 💉 Eli Lilly | –$37.60 | 2.45% |

| ORA | 📞 Orange | –$7.97 | 2.64% |

| BTI | 🚬 British American Tobacco | –$5.22 | 1.37% |

| CSSMI | 🇨🇭 iShares SMI ETF | –$9.11 | 11.04% |

| BYDDY | 🚗 BYD | +$14.20 | 2.53% |

| TCEHY | 🧧 Tencent | +$18.40 | 1.74% |

| JD | 📦 JD.com | +$5.96 | 2.30% |

💵 Total Value: $8,234.55

📈 Total Unrealized P&L: +$518.54

May 6th 2025

Here’s how my portfolio performed recently, highlighting gains and a few minor setbacks:

| 🏷️ Ticker | 🏢 Company | 💰 Unrealized P&L | ⚖️ Weight |

|---|---|---|---|

| MSFT | 🪟 Microsoft | +$21.10 | 4.00% |

| META | 🧠 Meta | +$12.70 | 3.93% |

| NVDA | 🎮 NVIDIA | +$12.60 | 10.22% |

| ADBE | 🎨 Adobe | +$10.20 | 3.78% |

| GOOGL | 🔍 Alphabet | –$0.65 | 3.31% |

| AAPL | 🍏 Apple | +$0.14 | 6.40% |

| QCOM | 📡 Qualcomm | –$7.01 | 1.98% |

| MU | 💾 Micron | +$1.74 | 1.83% |

| TXN | 🧮 Texas Instruments | –$2.20 | 2.10% |

| ASML | 🛠️ ASML | +$2.06 | 9.10% |

| TSM | 🧪 Taiwan Semiconductor | +$8.55 | 2.82% |

| OR | 💄 L’Oréal | –$1.58 | 3.58% |

| MC | 👜 LVMH | –$5.58 | 3.88% |

| BABA | 🧧 Alibaba | –$1.07 | 6.38% |

| AMZN | 📦 Amazon | –$2.57 | 3.53% |

| CAT | 🚜 Caterpillar | +$8.07 | 4.06% |

| LLY | 💉 Eli Lilly | –$21.10 | 4.09% |

| ORA | 📞 Orange | –$0.22 | 4.48% |

| BTI | 🚬 British American Tobacco | +$5.96 | 2.45% |

| CSSMI | 🇨🇭 iShares SMI ETF | –$3.34 | 18.12% |

💵 Total Unrealized P&L: +$37.80 ✅

🧾 Total Market Value: $5,053.37

Older update:

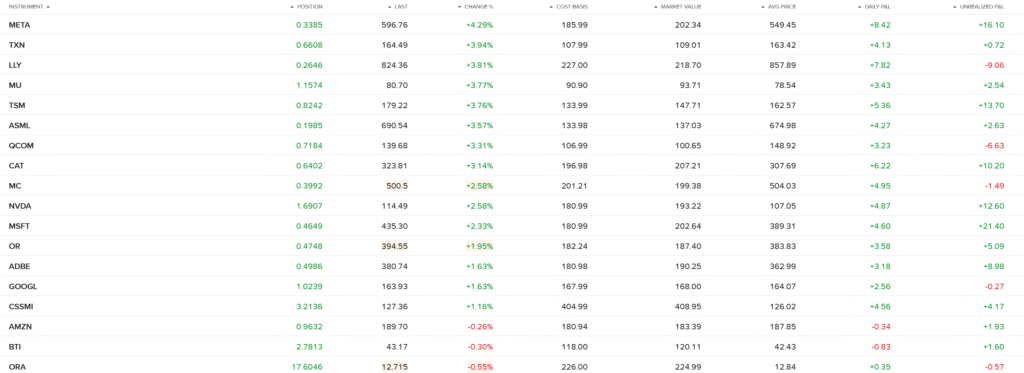

| Ticker | Company | Position | Price ($) | Change (%) | Market Value ($) | Daily Gain ($) | Total Gain ($) |

|---|---|---|---|---|---|---|---|

| META | Meta | 0.3385 | 596.95 | ✅ +4.32% | 202.34 | +8.40 | +16.10 |

| TXN | Texas Instr. | 0.6608 | 164.80 | ✅ +4.13% | 109.01 | +4.33 | +0.92 |

| MU | Micron | 1.1574 | 80.85 | ✅ +3.96% | 93.70 | +3.55 | +2.67 |

| LLY | Eli Lilly | 0.2646 | 825.07 | ✅ +3.90% | 218.70 | +8.21 | 🔻 -8.67 |

| TSM | TSMC | 0.8242 | 179.20 | ✅ +3.75% | 147.71 | +5.34 | +13.70 |

| ASML | ASML | 0.1985 | 690.03 | ✅ +3.49% | 137.03 | +4.51 | +2.87 |

| QCOM | Qualcomm | 0.7184 | 139.78 | ✅ +3.38% | 100.65 | +3.28 | 🔻 -6.57 |

| CAT | Caterpillar | 0.6402 | 323.43 | ✅ +3.02% | 207.21 | +6.01 | +10.00 |

| MSFT | Microsoft | 0.4649 | 435.38 | ✅ +2.35% | 202.64 | +4.64 | +21.40 |

| NVDA | Nvidia | 1.6907 | 114.18 | ✅ +2.30% | 193.22 | +4.34 | +12.00 |

| MC | LVMH | 0.3992 | 498.50 | ✅ +2.17% | 199.38 | +4.81 | 🔻 -1.63 |

| OR | L’Oréal | 0.4748 | 393.65 | ✅ +1.72% | 187.40 | +3.28 | +4.78 |

| ADBE | Adobe | 0.4986 | 380.85 | ✅ +1.66% | 190.25 | +3.09 | +8.89 |

| GOOGL | Alphabet | 1.0239 | 163.79 | ✅ +1.54% | 168.00 | +2.54 | 🔻 -0.29 |

| CSSMI | CSSMI | 3.2136 | 127.36 | ✅ +1.16% | 408.95 | +4.56 | +4.17 |

| AMZN | Amazon | 0.9632 | 190.09 | 🔻 -0.06% | 183.39 | 🔻 -0.11 | +2.15 |

| BTI | Brit Amer. | 2.7813 | 43.15 | 🔻 -0.35% | 120.11 | 🔻 -0.42 | +2.01 |

| ORA | Orange | 17.6046 | 12.72 | 🔻 -0.55% | 224.99 | 🔻 -0.62 | 🔻 -1.54 |

Highlights:

- 🌟 Meta and Texas Instruments leading today’s gains!

- 📉 Orange is currently experiencing a small dip.

Stay tuned for more updates and investment insights!

Rocket Mint shares money lessons and investment tips, straight from real-life wins, fails, and “oops” moments—so you can (maybe) do better.