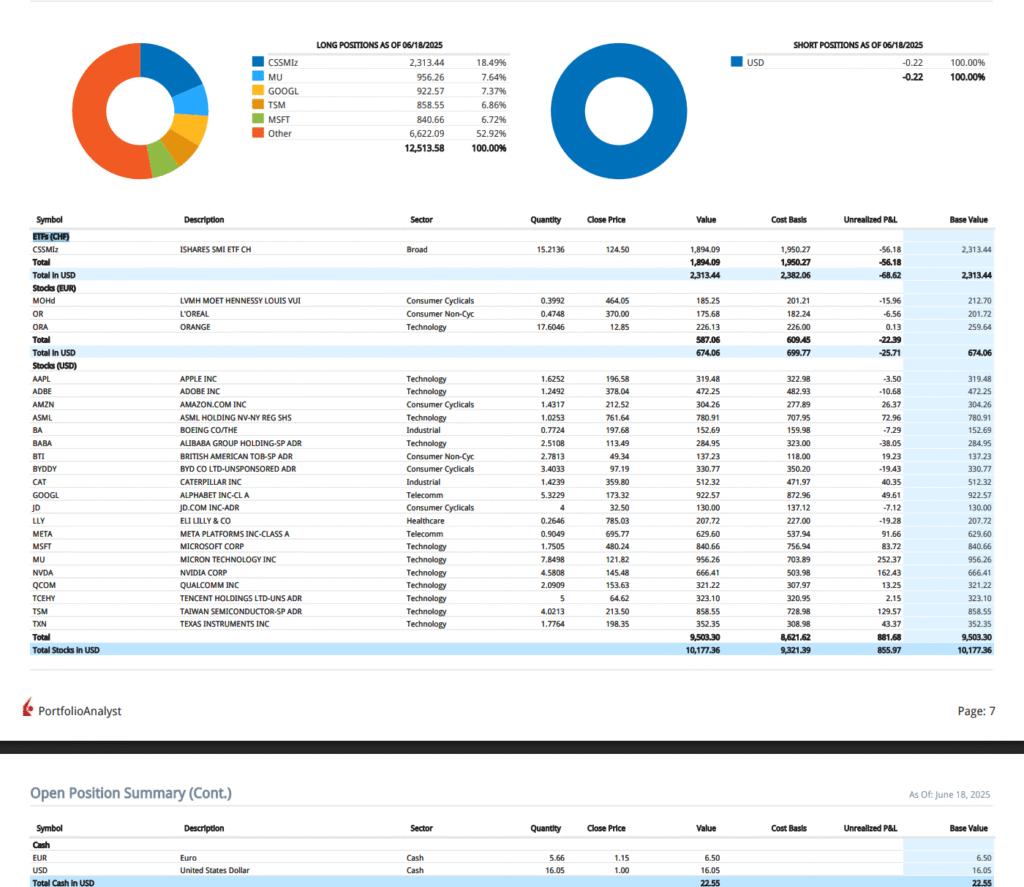

Here’s a detailed look into my current investment positions — a mix of ETFs and hand-picked stocks from both U.S. and European markets. This breakdown shows my asset allocation, top holdings, unrealized gains, and the sectors I’m leaning into.

🧾 Total Portfolio Value: $12,513.58

- Long Positions: $12,513.58

- Short Positions: -$0.22 (essentially negligible — small USD FX movement)

🧩 Asset Allocation

- ETF Exposure (CSSMI – Swiss Market ETF): $2,313.44 (18.49%)

- Top 5 Stocks:

- MU (Micron Technology): $956.66 (7.64%)

- GOOGL (Alphabet Inc. – Class A): $922.57 (7.37%)

- TSM (Taiwan Semiconductor): $856.00 (6.84%)

- MSFT (Microsoft): $840.66 (6.72%)

- Other Holdings: $6,622.09 (52.92%)

This distribution gives me both global exposure and tech-heavy upside potential, while keeping some local stability via the CSSMI ETF.

💡 ETF Holdings

- CSSMI – iShares SMI ETF CH:

- Quantity: 15.216

- Value: $2,313.44

- Unrealized P&L: -$68.68

The Swiss ETF is slightly in the red, but I’m holding this for long-term local market stability.

🏢 European Stock Positions

- LVMH, L’Oréal, Orange (ORA):

- Combined Value: $587.06

- Unrealized P&L: -$22.39

Small, symbolic positions in luxury and telco, mostly for diversification. These haven’t moved much.

🇺🇸 U.S. Stock Portfolio

🔝 Top U.S. Positions by Value:

- GOOGL: $922.57 (+$49.51)

- MU: $956.66 (+$146.51)

- MSFT: $840.66 (+$51.04)

- NVDA: $862.61 (+$153.86)

- TSM: $856.00 (+$127.57)

These tech giants are doing the heavy lifting. NVDA and MU are clear stars with strong double-digit gains since purchase.

🟥 Bottom Performers:

- LLY (Eli Lilly): -$12.31

- BABA (Alibaba): -$11.86

- USD Cash Position (FX Impact): -$9.12

Not every pick is a winner, but the winners are far outweighing the laggards.

💰 Cash Holdings (FX Breakdown)

- EUR Cash: €5.66 → $6.50

- USD Cash: $16.65

- Total Cash: $22.55 (0.18% of the portfolio)

Nearly fully deployed — I’m comfortable staying aggressive in the current environment.

Leave a Reply